Giving eligible appreciated stocks, mutual funds or employee stock option shares through a community foundation is popular choice with a range of givers — individual investors, families, entrepreneurs, and even groups of friends who have formed investment clubs.

By giving stock through The Guelph Community Foundation, you can avoid capital gains taxes that would be due as a result of the sale of the stock and establish a charitable fund that benefits the local causes and organizations you care about most. With gifts of appreciated stock, your stock market earnings translate into community impact, so you get a more rewarding return on your portfolio. You can support special programs for youth at-risk, senior citizens, address environmental concerns or support the arts, the choice is yours.

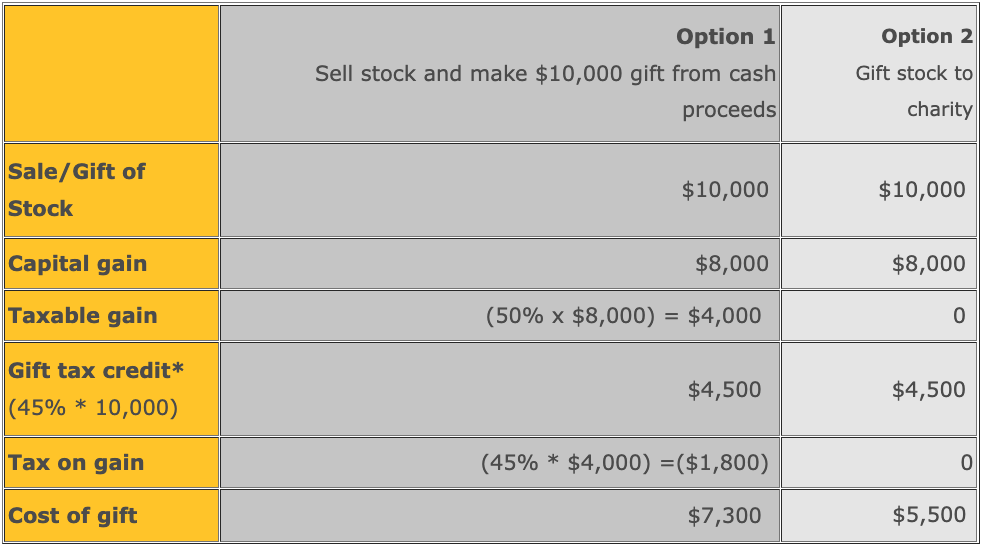

Example: Donor wishes to make a gift of $10,000

Fair market value of stock is $10,000 (cost base of stock $2,000)

*For illustration purposes a combined tax rate of 45% was used. Please note that combined tax rates vary across the provinces.